🌱 Cistercians, DALL-E & Brassica Oleracea

10 January 2021

Welcome back to the Week That Was series where we highlighting things from the interwebs which are interesting, noteworthy and/or probably worth your time.

Articles📝, Tweet(s)📱, Videos🎥, Charts 📈 all fair game with or without attendant commentary.

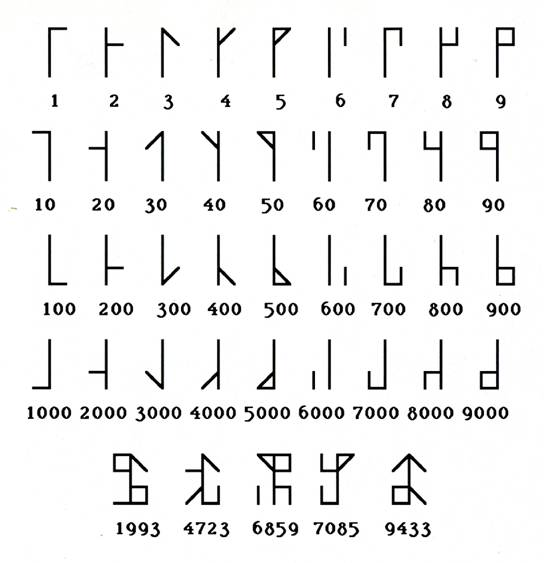

🧮 Cistercians

Cistercian monks made this numeral system in the 13th century. A single symbol could represent numbers up to 9999. They were used for years, divisions of texts, the numbering of notes and other lists, indexes and concordances, arguments in Easter tables, and even for musical notation.

The folks over at Numberphile put together a ten minute explainer

₿🚀🌙 When Correction?

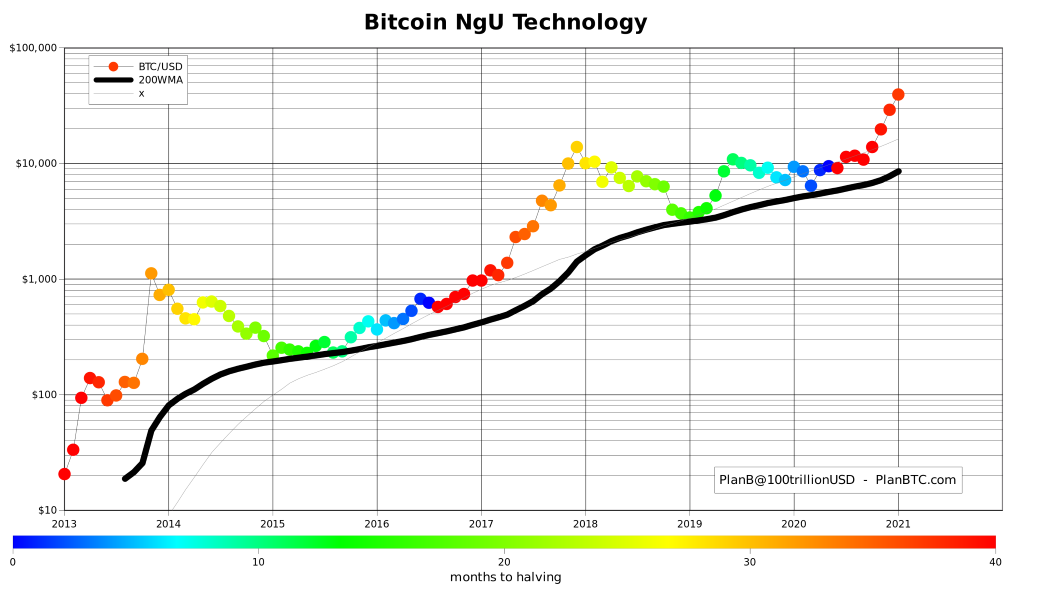

BTC marching $1000 per day for a straight 21 days in December meant it blasted through it’s previous ATH all the way to $40,000+ levels. Stunning performance.

The Digital Gold narrative is definitely propagating within the institutional and (increasingly) corporate landscape as we’ve previously observed on these pages.

Looks like more investors are shifting their money out of Gold and into digital Gold. While #Bitcoin has hit fresh ATH >$41k, #Gold drops almost 4%. pic.twitter.com/XCeocExdZj

— Holger Zschaepitz (@Schuldensuehner) January 8, 2021

Undoubtedly an extremely overheated asset, it does still appear to be tracking @PlanB’s S2FX model which we also looked at a few months ago. If so, some cooling is predicted by the model, before potentially marching onto even giddier heights, due mainly to massive buying pressure (from the likes of Grayscale), the effects of the halving a few months ago and general retail FOMO.

Some say the cooling may precipitate “altszn” also known as Alt Season or Altcoin Season - the overperformance of some of BTC’s peers.

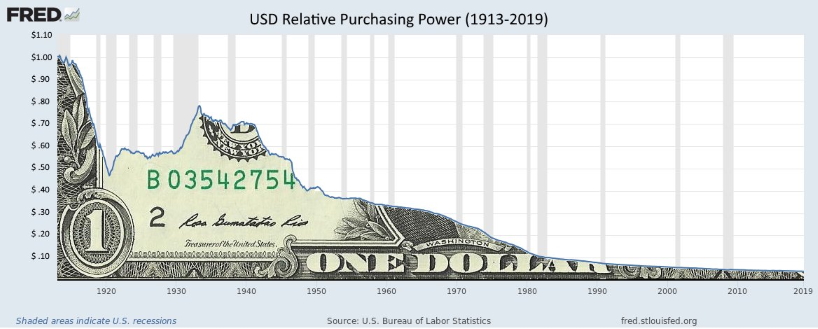

The likelihood of another few trillion dollars of stimulus in the US and continued loose monetary policy seems to be a bullish signal for the BTC maxis who continue to anticipate continued erosion of USD purchasing power and asset price inflation.

Citing facts like “75% of the US dollars in circulation were printed after Satoshi published his whitepaper”

None of this is investment advice, please be very careful out there kids.

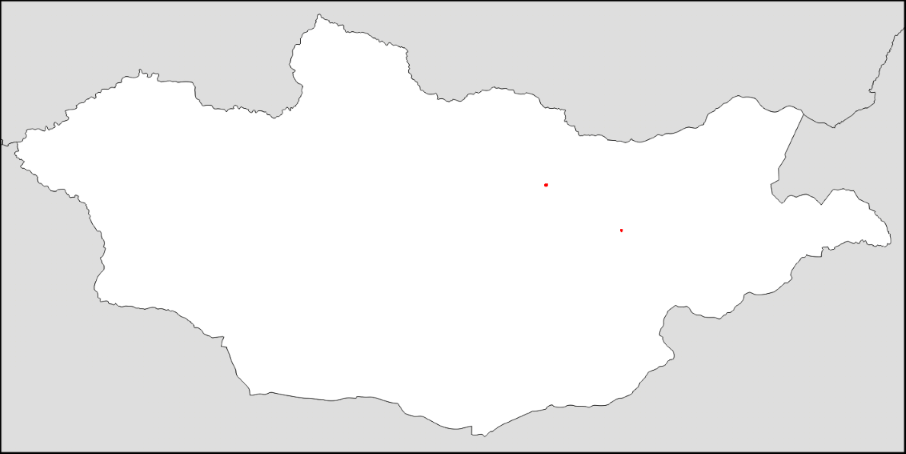

🗺️ Mongolia

Half the population of Mongolia lives in those two red dots

🤷♂️ Where’s Jack?

“Every day is uncertain. The only certain day was yesterday,” - Jack Ma

After an explosive failed IPO and what appears to be a run-in with Chinese leadership, Alibaba’s Jack Ma has been missing now since October.

After much speculation about his fate, 📝CNBC report that he’s been asked to “lay low”. Who knows. NPR discuss the matter very briefly below.

What seems evident is after an incredible rise, Ant Financial is almost certainly no longer likely to IPO; and there’s increasing evidence that Ant Group is in the CCP’s crosshairs and may even be broken up.

The move brought back memories of the disappearance of Fan BingBing in 2018 - notable for her profile as well, being China’s biggest movie star with a net worth estimated at $100 million at the time.

Vanity Fair’s longread - 📝“The Big Error Was That She Was Caught”: The Untold Story Behind the Mysterious Disappearance of Fan Bingbing, the World’s Biggest Movie Star

🎨🤡 Censorship?

“If I can’t have you, no one can." - Sator, TENET (2020)

If I can’t have her…, Adam the Creator, Digital, 2021

Stratechery dusted off a 2019 article - 📝“A Framework for Moderation” - in light of events in the last week, particularly debate about social media moderation and censorship.

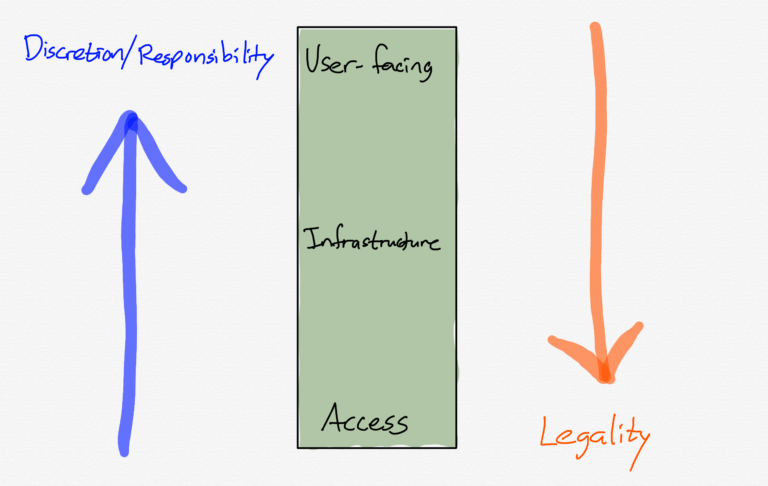

It makes sense to think about these positions of the stack very differently: the top of the stack is about broadcasting — reaching as many people as possible — and while you may have the right to say anything you want, there is no right to be heard. Internet service providers, though, are about access — having the opportunity to speak or hear in the first place. In other words, the further down the stack, the more legality should be the sole criteria for moderation; the further up the more discretion and even responsibility there should be for content:

🤖🖌️ DALL-E

OpenAI have trained a neural network called DALL·E that creates images from text captions for a wide range of concepts expressible in natural language.

🌴🌆 Urban Jungle

Although apparently most people actually don’t notice it since it’s below street level and covered by big shrubs. This is what people passing by see.

🎧💱 Code of Capital

Hidden Forces’ Demetri speaks with Katharina Pistor, a leading scholar of corporate governance, money & finance, property rights, and comparative law & legal institutions.

She’s also a prominent commentator on cryptocurrencies, has testified before Congress about them, and has written papers dealing with the issues of digital statehood and monetary sovereignty. Her latest book, “The Code of Capital,” is a tour de force that explains in captivating detail how the law is used to code and construct capital, protecting some assets over others, how this creates wealth for society, and how its use and abuse can make the difference between societal cohesion and political revolution. In today’s conversation, you will learn how the law—a powerful tool for social ordering and wealth creation—has been put to work in the service of private consolidation and political control.

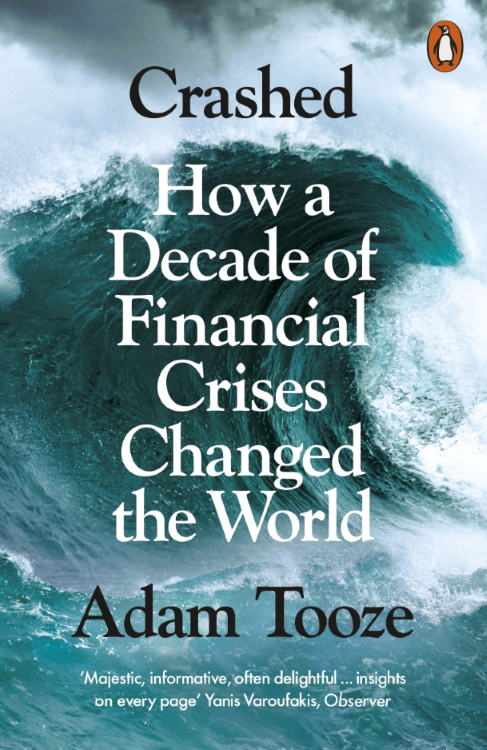

💴💶💵 Crash

I’ve really enjoyed this deep-dive into the 2008 Great Financial Crisis by historian Adam Tooze. It’s truly epic in scope, breadth and depth (it earns it’s 720 pages).

I enjoyed this Goodreads review by Indumugi.

If there is one book you’d point out to, to learn about the global financial crisis of 2008 - the storm that gathered it, the decisions made to contain it and the aftershocks of the decisions it will definitely be Crashed. My decision to pick this book was timely, I was free during the pandemic and wanted to learn something important in a comprehensive way. People casually mention the GFC many times, but I never really understood the length and breadth of the crisis. This was my attempt to know more and be informed. Little did I know, by the time I finished this book, I was more informed not just about what caused the GFC in the US, but also the Eurozone crisis, and the Chinese crisis. Learning some financial tools/terminologies before reading this book will help a lot; I read the news - news on stimulus, central bank swap lines, etc. That’s precisely why the time was right.

The ultimate focus of this book is the way Tooze attempts to explain how deep financial integration is across all countries. In his own words he traverses through the challenges posed by “the transatlantic dollar-based financial system, the eurozone and the post-Soviet sphere of Eastern Europe.”

Previously whatever I knew of the Ukraine crisis (2013) was only the protests against the Yanukovych government and the fervor with which the fight for freedom happened. Chapter 21: “F*** the EU: The Ukraine Crisis” really helps one put in place what the Maidan activists were demanding against the limited political choices available to Ukraine at that time. The involvement of the US, the EU due to the deep financial stakes involved and fueled by the political provocation staged by the protesters was very telling of the transatlantic nature of the financial system.

Altogether, this was a brilliant account of the crisis and would highly recommend to anyone who has the time and interest to read on this topic.*

💉🦠🧼🖐💦⚕ Greenzone

📊

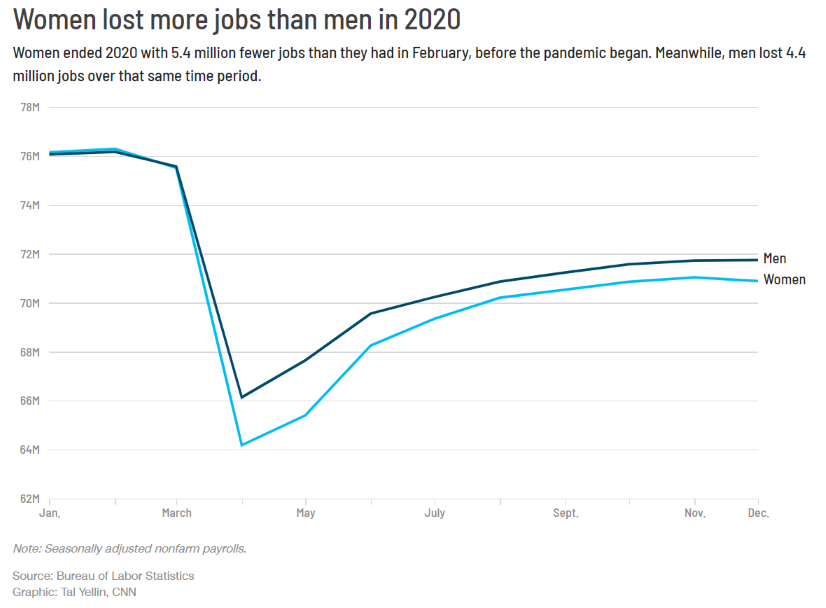

Bifurcations in fortunes in light of covid-19 continue to present.

According to new US data released Friday, employers cut 140,000 jobs in December, signaling that the economic recovery from the coronavirus pandemic is backtracking. Digging deeper into the data also reveals a shocking gender gap: Women accounted for all the job losses, losing 156,000 jobs, while men gained 16,000.

💉

In rather excellent news however, 📝a new 06 January study shows immune cells primed to fight the coronavirus should persist for a long time after someone is vaccinated or recovers from infection.

Covid-19 patients who recovered from the disease still have robust immunity from the coronavirus eight months after infection, per Neel V. Patel.

📊

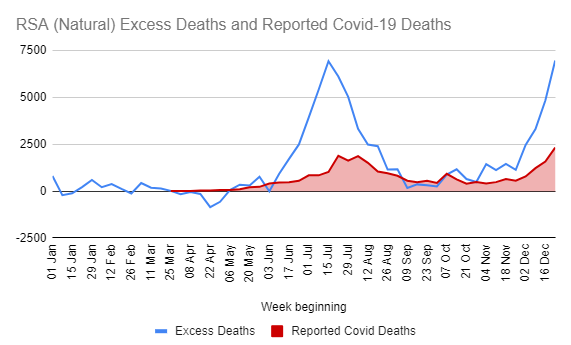

South Africa’s excess death figures remain disconcertingly high. Likely predominantly unattributed SARS-CoV-2 mortality, although possibly deaths due to hospital strain and even the economic effects of the pandemic/lockdown.

📊

Regular readers know that SARS-Cov-2 has replaced influenza, which disappeared world-wide in April 2020.

— Stefan Homburg (@SHomburg) January 3, 2021

This report from the CDC notes that the four common corona viruses have also been replaced by their young relative. @AlexBerenson @FatEmperorhttps://t.co/Cv3eZr7BDY pic.twitter.com/UYGdGqk1mb

👨⚕️

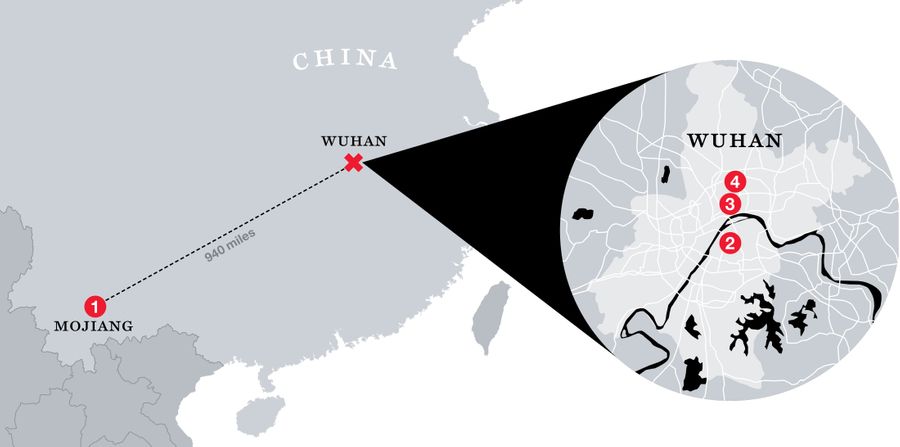

Meanwhile, as investigators continue to try and investigate the origins of the novel coronavirus, Chinese authorities barred entry to WHO officials.

Not great, as this leaves open space for endless speculation and conspiracy. 📝NYMag’s Intelligencer are re-tabling the underexplored lab narrative in this epic longread.

The Lab-Leak Hypothesis For decades, scientists have been hot-wiring viruses in hopes of preventing a pandemic, not causing one. But what if …?

💬📜 Quotes

“History viewed from the inside is always a dark, digestive mess, far different from the easily recognizable cow viewed from afar by historians.” ― Dan Simmons, Hyperion

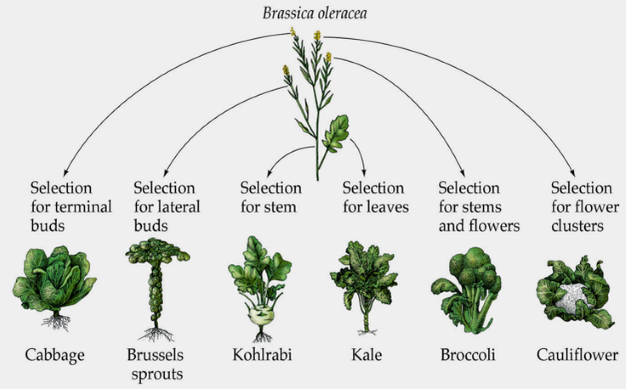

🌱 Brassica Oleracea

Artificial selection really has transformed many a species of plant. @merrittk’s reaction is understandable… as is this meme.

🚗🚗🚗 Traffic

Blog fav CGP Grey’s 2016 solution to traffic

From the comments:

teacher: why are you late

me: a chicken crossed the road 4 hours ago

🎨 Reach out

Reach out, Valentin Pavageau, Digital, 2020

📧 Get this weekly in your mailbox

Thanks for reading. Tune in next week. And please share with your network

Links The Week That Was Pickings

fa17eab @ 2023-09-18