⛰️ Hill Climbing, Music Predictions & Web 3.0

01 November 2021

Welcome back to the Week That Was series highlighting things from the interwebs which are interesting, noteworthy and/or probably worth your time.

Articles📝, Tweet(s)📱, Videos🎥, Charts 📈 all fair game with or without attendant commentary.

This week is defintely a visual edition.

🎶🔮 12 Music Predictions

Author, jazz critic and music historian Ted Gioia 📝wrote a post outlining his 12 Predictions for the Future of Music. I found them interesting and outline them below with a line or two from each one - the full article outlines them in more detail.

Record labels gradually lose both the ability and desire to develop new artists—there simply won’t be enough profit in young talent to justify the large required investments.

More new artists will get their big break from web platforms (TikTok, YouTube, Peloton, Bandcamp, etc.) than from record labels.

Listeners have favorite new songs, but not know (or care) about the name of the artist. “You’ve gotta hear this great song on my workout playlist. . . .”

Musician incomes will continue to shrink, but some young musicians will still earn large sums of money—however, their big paydays will come more from branding, licensing, and ancillary deals than recordings

Dead musicians will start showing up everywhere—via holograms, biopics, deepfake vocals, and other technology-driven interfaces

Dead musicians will start by giving tours in concert halls, but as the cost of the technology goes down, they will begin performing everywhere.

Exciting new music trends will continue to emerge, but increasingly they will arrive from outside the major Anglo-American urban centers that previously determined what songs people heard. A-Pop from Africa, I-Pop from India or Indonesia, and a whole host of competing sounds and styles from Latin America, China, Eastern Europe, etc.

The legacy cash flows enjoyed by publishers will make acquisitions of old songs, especially publishing rights the last safe haven in the music business.

A huge portion of “music profits” will actually go to tech companies (Apple, Google, etc.), who have no interest in reinvesting this cash into the music ecosystem

All the innovations in music tech will come from outside of the legacy music industry.

Record labels will increasingly pursue a bare-bones, low investment approach.

The greatest dream of the music execs will be. . . to get out the music business. They will try to sell NFTs or promote audiobooks or finance biopics or sell music-themed apparel or open music-themed casinos, etc., etc..

🌍🏦 African GDP

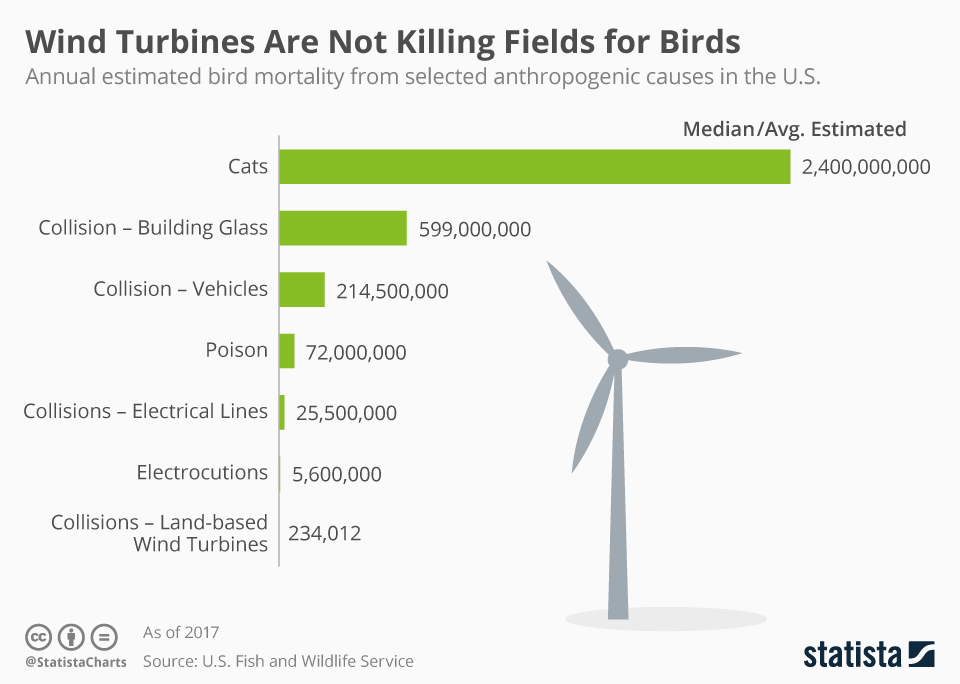

💨🐦 Cats v Turbines: Birds

There’s a narrative which is sometimes quoted as an argument against wide-scale use of wind turbine energy generation - which is that it kills huge amounts of birds.

If anthropogenic causes of bird deaths are are top of the priority list, you should probably start with banning house cats.

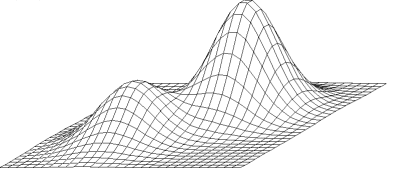

🖥️🎞️ ADOP

ADOP: Approximate Differentiable One-Pixel Point Rendering

— AK (@_akhaliq) October 14, 2021

abs: https://t.co/npOqsAstAx pic.twitter.com/LE4ZdckQPO

🧗⛰️ Climbing the wrong hill

Classic post from 2009 on 📝Chris Dixon’s blog using a classic programming problem as an analogy for career choices. Some excerpts:

A classic problem in computer science is hill climbing. Imagine you are dropped at a random spot on a hilly terrain, where you can only see a few feet in each direction (assume it’s foggy or something). The goal is to get to the highest hill. Consider the simplest algorithm. At any given moment, take a step in the direction that takes you higher. The risk with this method is if you happen to start near the lower hill, you’ll end up at the top of that lower hill, not the top of the tallest hill.

Another and generally better algorithm has you repeatedly drop yourself in random parts of the terrain, do simple hill climbing, and then after many such attempts step back and decide which of the hills were highest. Going back to the job candidate, he has the benefit of having a less foggy view of his terrain. He knows (or at least believes) he wants to end up at the top of a different hill than he is presently climbing. He can see that higher hill from where he stands.

People early in their career should learn from computer science: meander some in your walk (especially early on), randomly drop yourself into new parts of the terrain, and when you find the highest hill, don’t waste any more time on the current hill no matter how much better the next step up might appear.

🎨 NIGHTMARE

WILL THIS NIGHTMARE EVER END? Billy Vanilli, Oil on Canvas, 2021

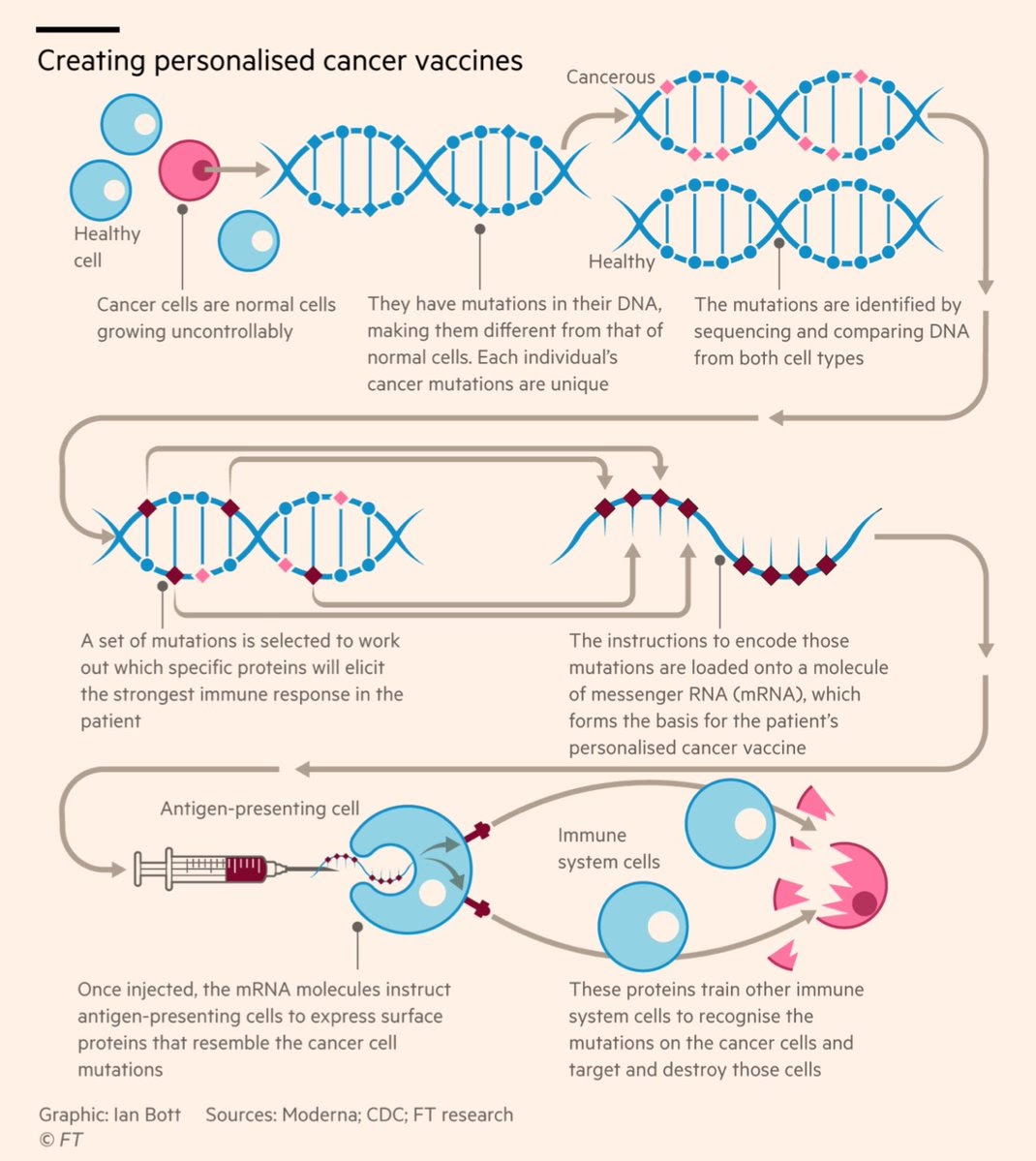

💉🧬 mRNA Vaccines

Eric Topol highlighted an 📰FT article noting how the breakthrough mRNA Covid vaccine has kickstarted an entirely new generation of vaccines for a range of diseases.

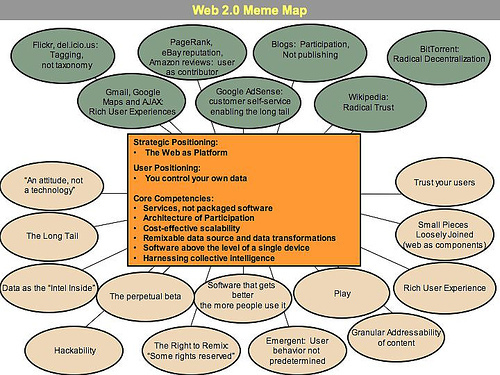

🌐 Web 1,2,3

With Web3.0 becoming the de facto standard for the next iteration of the internet via the collection of decentralisation, privacy and user-owned-network protocols - worth going back to see 📚how O’Reilly defined the Web2.0 which dominated the last two decades and saw the rise of the likes of Facebook.

Web 1.0 –> Web 2.0:

- DoubleClick –> Google AdSense

- Ofoto –> Flickr

- Akamai –> BitTorrent

- mp3.com –> Napster

- Britannica Online –> Wikipedia

- personal websites –> blogging

- evite –> upcoming.org and EVDB

- domain name speculation –> search engine optimization

- page views –> cost per click

- screen scraping –> web services

- publishing –> participation

- content management systems –> wikis

- directories (taxonomy) –> tagging (“folksonomy”)

- stickiness –> syndication

The Web As Platform

Now that we’ve reminded ourselves what Web2.0 meant, let’s turn to 3.0. Benedict Macon-Cooney wrote a decent piece on Discourse Magazine about how 📝“Decentralizing the internet will provide new opportunities for innovation and progress”

🎙️

Andreessen Horowitz partner Chris Dixon and AngelList founder Naval Ravikant joined Tim Ferris to unpack the concept further - talking Web3, How to Pick the Right Hill to Climb, Finding the Right Amount of Crypto Regulation, Friends with Benefits, and the Untapped Potential of NFTs and more

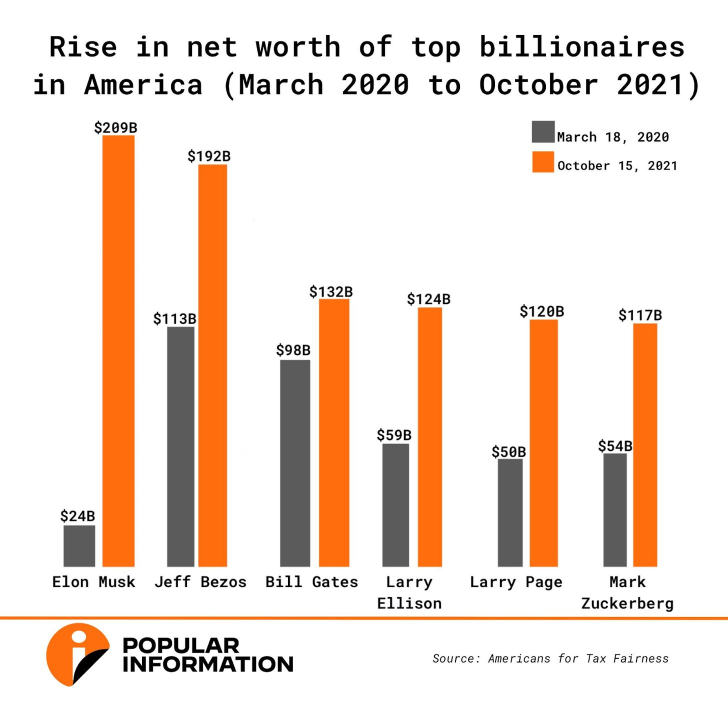

🤑⚖️ Billions

The pandemic has had pretty divergent fortunes for people and corporations alike. The scale of the upside that the world’s billionaires have experienced is pretty incredible though. To wit:

(Per JuddLegum)

Increase in wealth (March 2020 to October 2021):

- MUSK: $24 BILLION ➡️ $209 BILLION

- BEZOS: 113B ➡️ 192B

- GATES: 98B ➡️ 132B

- ELLISON: 59B ➡️ 124B

- PAGE: 50B ➡️ 120B

- ZUCKERBERG: 54B ➡️ 117B

From Popular Information

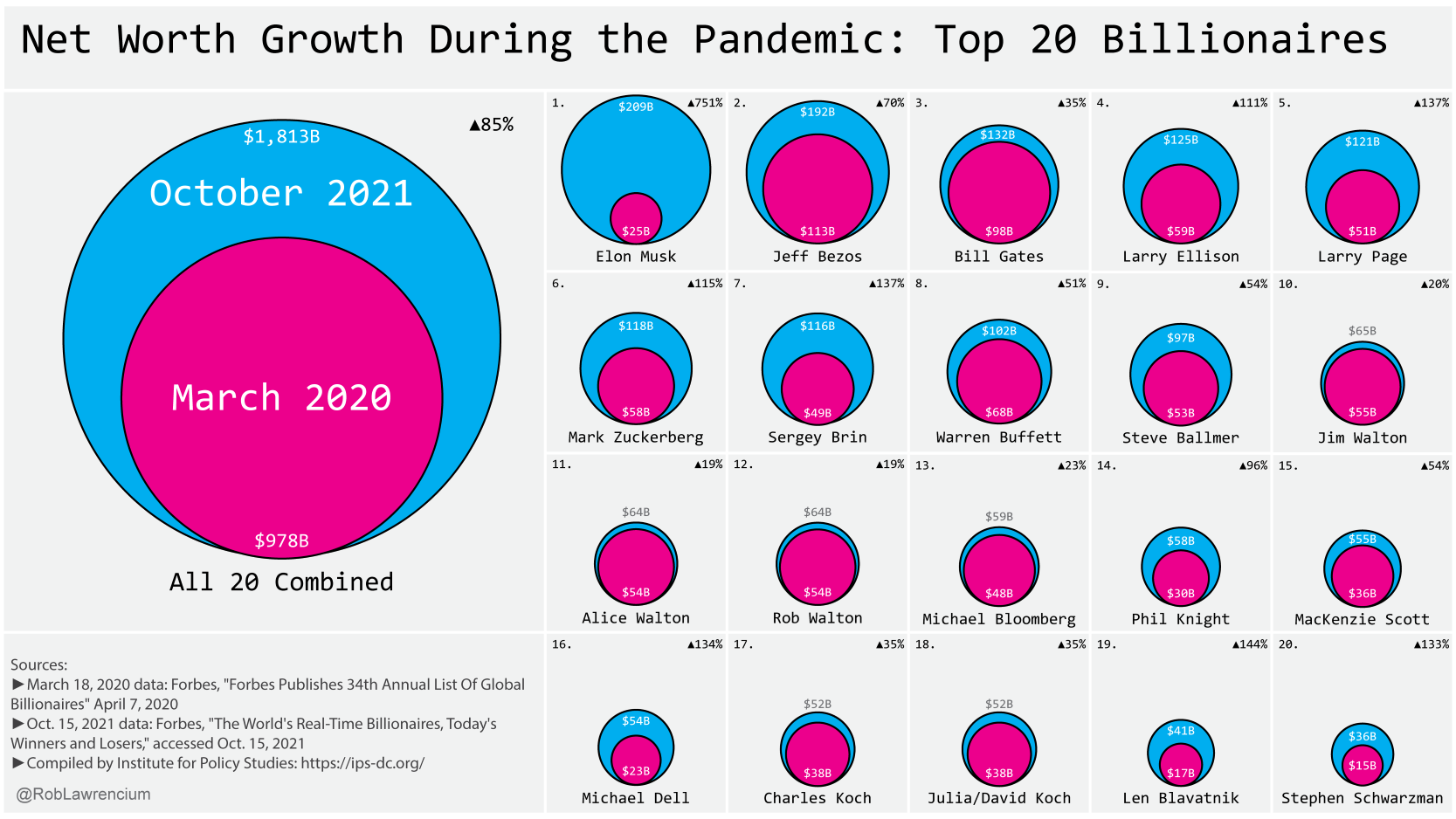

Reddit User u/CognitiveFeedback showed these changes in an equally enlightening graphic.

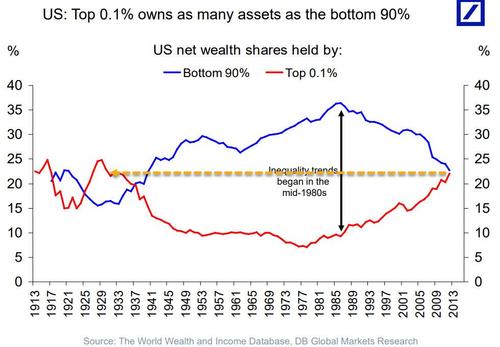

What this means is that the wealth of the top 0.1% in the US has converged with the wealth of the bottom 90% (an inequality phenomenon we’re very familiar with in RSA given our being top of the world’s Gini Coefficient Index).

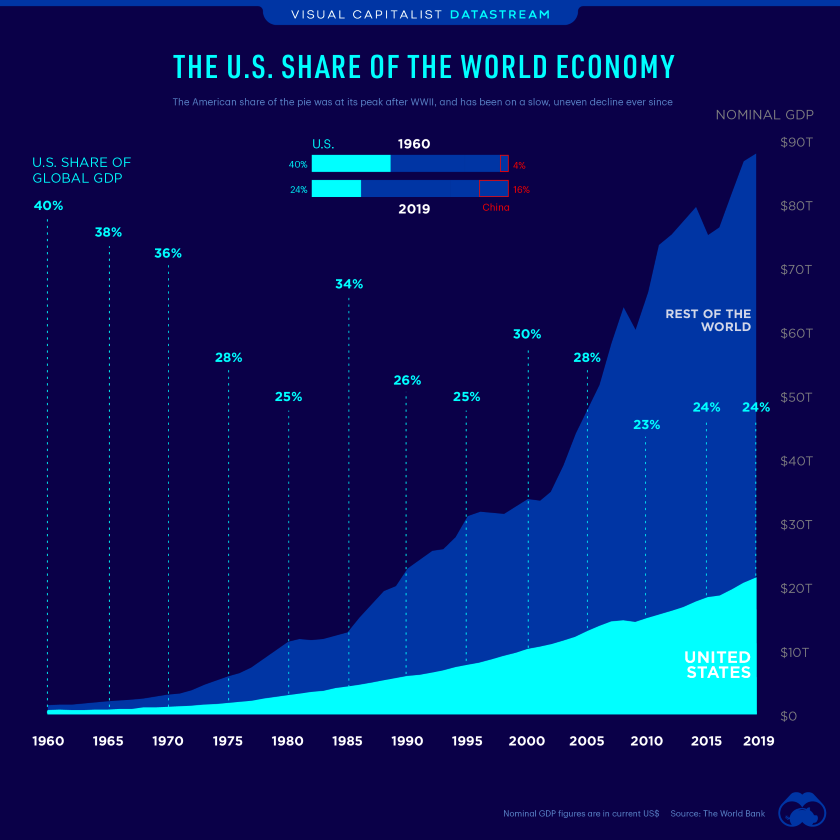

The above trends having transpired all while the US’s share of global GDP came down from an astonishing 40% to the now 24%

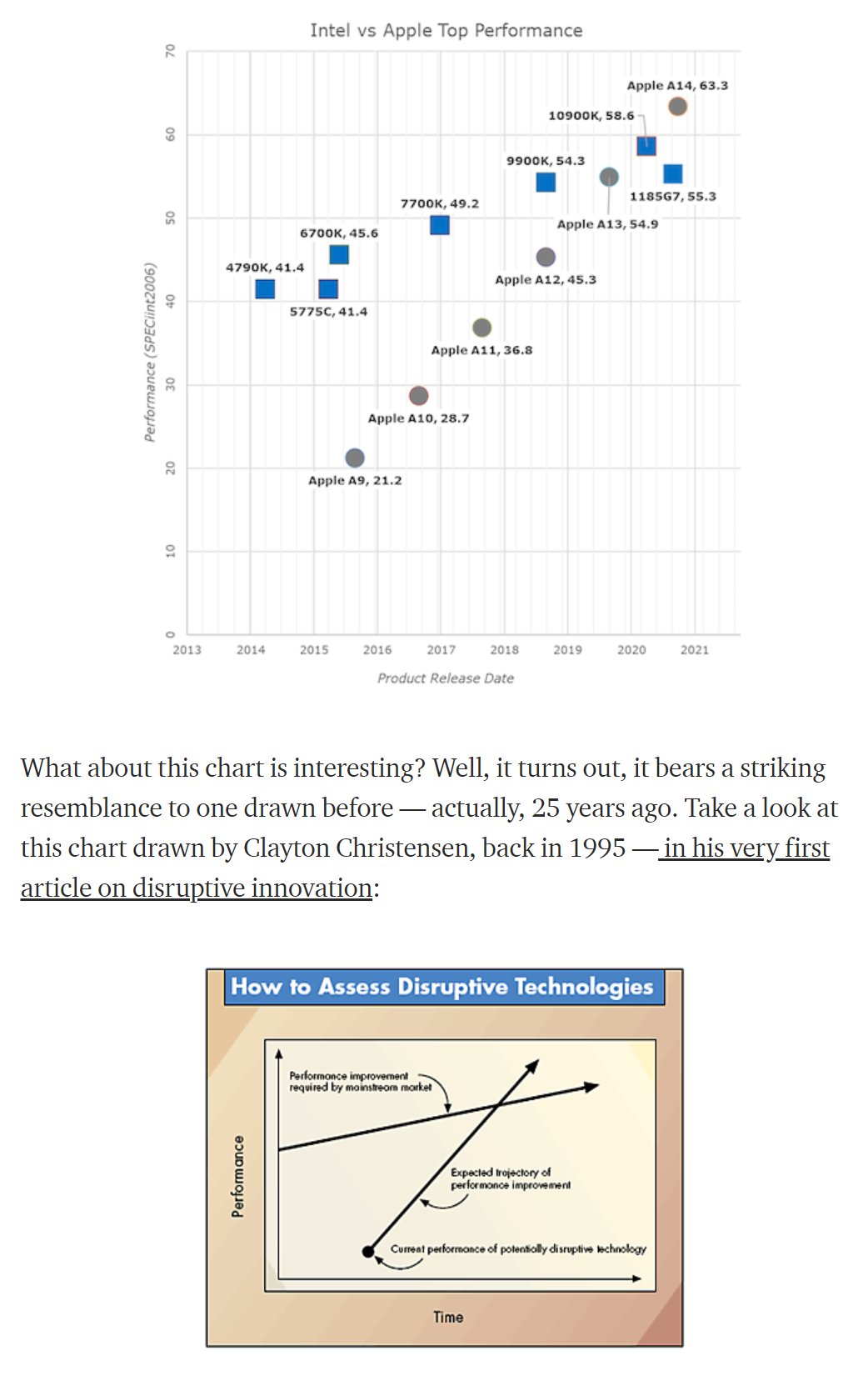

💻 Apple’s Disruption

It’s interesting to see how Apple’s new M1 chip appears to come straight from the playbook Clayton M. Christensen & Joseph L. Bower’s introduced in 📰this 1995 HBR article where they first outlined the disruptive innovation framework.

Intel’s Disruption is Now Complete

— James Allworth (@jamesallworth) November 11, 2020

With Apple’s new M1 processor, ARM has finally disrupted Intel’s x86 architecture https://t.co/TJ3nJnWSXl

🐕💰 $SHIB

If this Edward Snowden’s tweet makes sense to you - not just the dog money but the derivative of dog money aspect of it - then you’ll know all about the Shiba Inu ($SHIB) token already.

i say this with love:

— Edward Snowden (@Snowden) October 31, 2021

if you got talked into exchanging your hard-earned savings for some new dog money because a meme said you'd get rich, please carefully consider your odds of outsmarting a market that sold to you its stake in *not even dog money but a CLONE of dog money*

What you may not be aware is there’s a wallet which made a $8,000 investment into the speculative meme coin whose value since peaked about 400 days later at an astonishing $5.7 billion… I hope they’ve started cashing out

This wallet bought roughly $8,000 of $SHIB last August.

— Morning Brew ☕️ (@MorningBrew) October 27, 2021

It's now worth $5.7 billion.

From $8,000 to $5.7 billion in roughly 400 days.

We may actually be looking at the greatest individual trade of all time. pic.twitter.com/LtdgQ83bKP

🟧📺 Trump & The Media

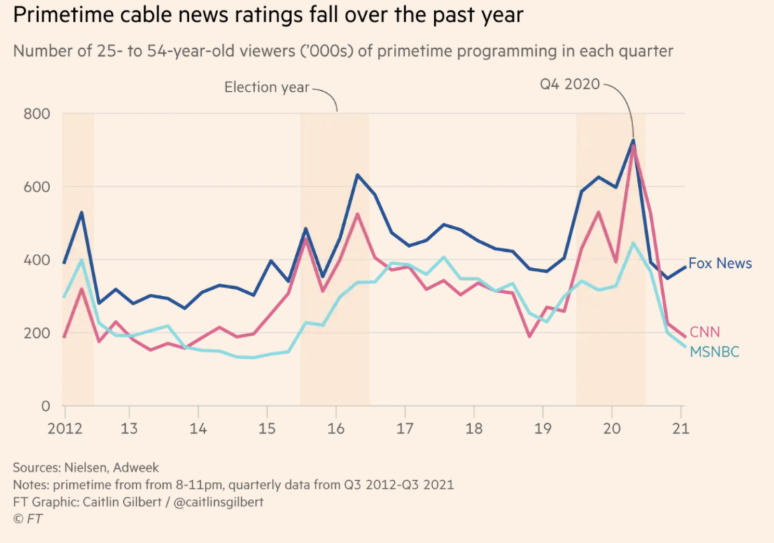

Donald Trump and Covid have been good for the media business. Cable TV ratings, in particular, have fallen off a cliff since Trump left office. Crisis and negativity are good for the media business. I muse whether they need another model…

Originally reported on FT

🌌🔭 Extra-Solar

First ever image of a multi-planet system around a Sun-like star

📸 This image, captured by the SPHERE instrument on ESO’s Very Large Telescope, shows the star TYC 8998-760-1 accompanied by two giant exoplanets. This is the first time astronomers have directly observed more than one planet orbiting a star similar to the Sun. It was captured by blocking the light from the young, Sun-like star (on the top left corner) using a coronagraph, which allows for the fainter planets to be detected. The bright and dark rings we see on the star’s image are optical artefacts. The two planets are visible as two bright dots in the centre and bottom right of the frame.

🎨 Soul Searching

Soul Searching, Dimitri Sirenko, Oil on canvas, 2021

💬 Deep Cuts

On presence

“In the name of God, stop a moment, cease your work, look around you” — Leo Tolstoy

“The true secret of happiness lies in taking a genuine interest in all details of daily life” — William Morris

🤵 One More Thing

📧 Get this weekly in your mailbox

Thanks for reading. Tune in next week. And please share with your network.

Links The Week That Was Pickings

fa17eab @ 2023-09-18