📉 Corrections, Found Stones & Unsolicited Advice

01 May 2022

Welcome back to the Week That Was series highlighting things from the interwebs which are interesting, noteworthy and/or probably worth your time.

Articles📝, Tweet(s)📱, Videos🎥, Charts 📈 all fair game with or without attendant commentary.

🎨 43 Billion Dollar Bird

43 Billion Dollar Bird, u/musketon, digital, 2022.

📉 Corrections

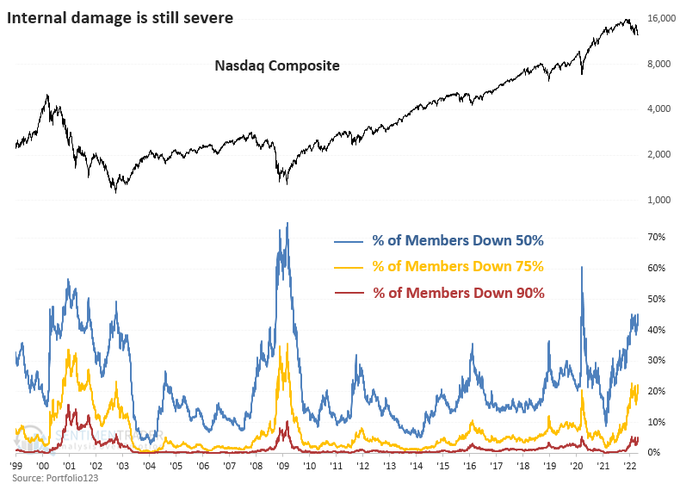

From Jason Goepfert, and discussed on 📹All-In this week around the wealth destruction currently underway in - particularly growth and tech-stock equity indices.

Internal Nasdaq damage:

- 😒More than 45% of stocks down 50%

- 😢More than 22% of stocks down 75%

- 🤬More than 5% of stocks down 90%.

The only comparisons are Oct 2000 - Oct ‘02 and Nov 2008 - Apr ‘09.

Ben Carlson notes some of the more breathtaking losses - which he notes are depression-level at this point:

- Teledoc -80%

- Zoom -82%

- Robinhood -86%

- Peloton -88%

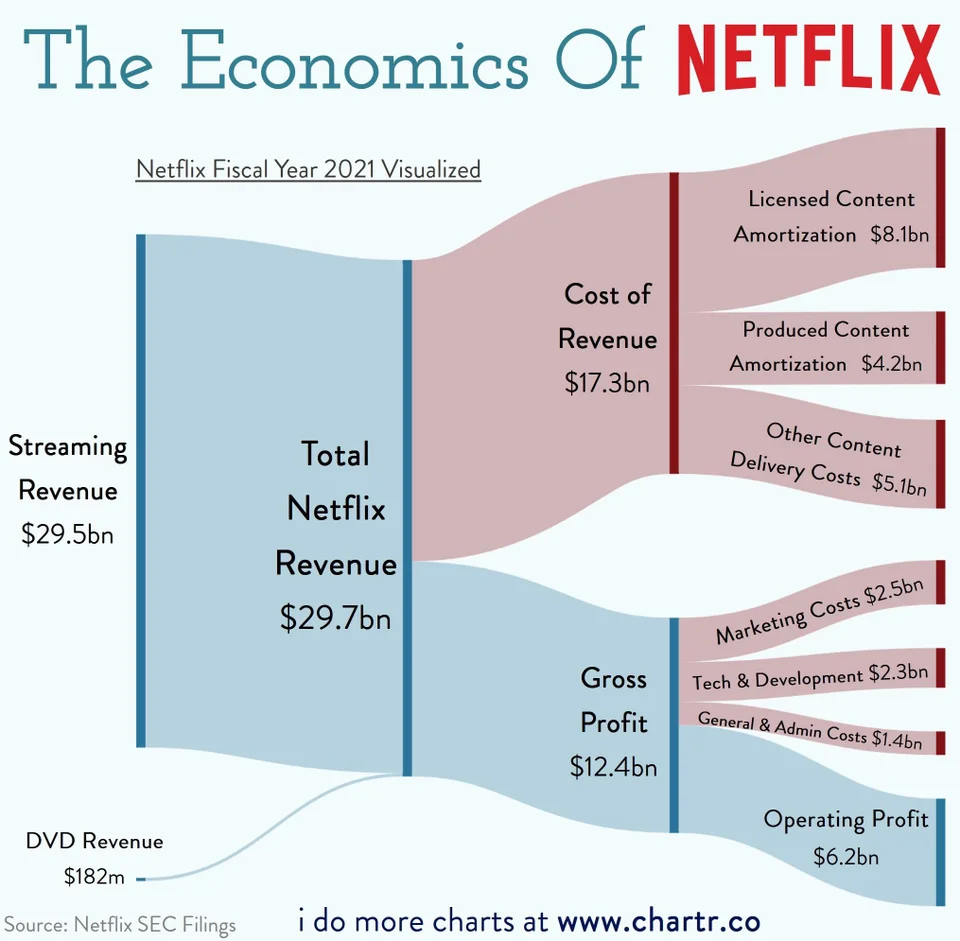

Having lost net 200,000+ subscribers in the last quarter (after expecting to gain 2,5m) and $225bn dollars in 5 months, Netflix is already under significant pressure. It’s the worst performing stock in the S&P500 and down almost 70% year to date. There’ve been a number of good takes looking at the underlying streaming business models and their sustainability. The prognosis is not really positive and the next few years could see more consolidations in this space.

Non-tech Movie & Series Youtuber Grace Randolph had some interesting thoughts.

We’ve now seen Netflix subscribers fall for the first time, the shares crashed, and it’s going to clamp down on password-sharing, rationalise spending and explore an ads model.

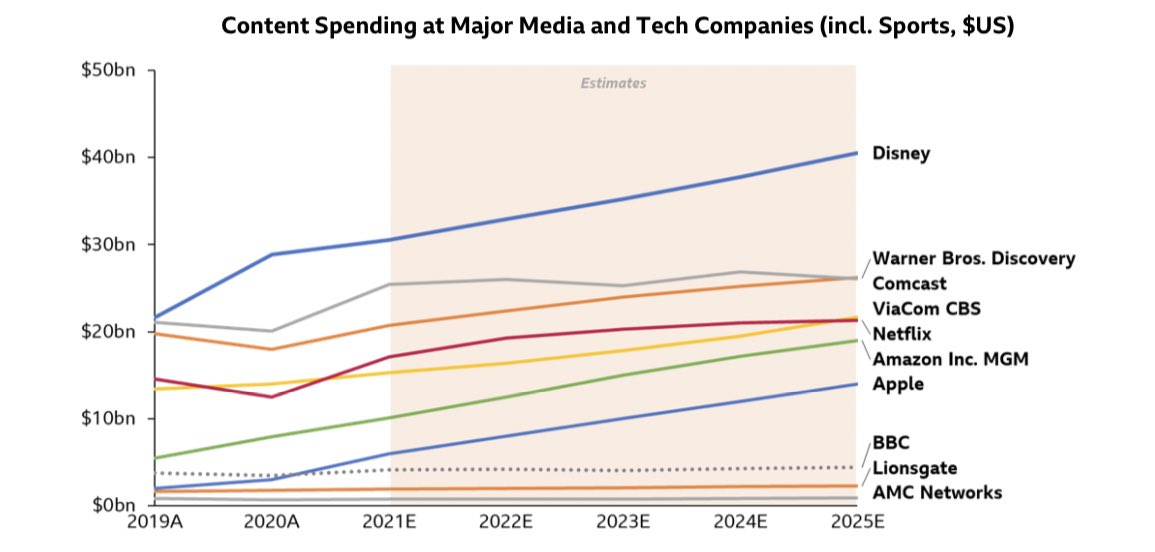

Here’s a comparison of what various players are spending on content.

Ex-Andreesen Horowitz Ben Evans - who penned “Netflix is not a tech company” back in 2019 - also shared some views on “Another Podcast”.

Netflix 2021 financials summarised

What we know for sure though. Streaming is hard (see the 📰short-lived Quibi) and we’ve seen another high-profile misfire with CNN+ starting and shutting down after 23 days in operation and roughly $300 million invested. From Ben Evans again:

The new CNN+ subscription streaming service is dead, just a month after launch. There is some debate as to how far this is due to a slow launch (though a month is not a long time to look for product-market-fit), a questionable strategy (it was mostly new content and didn’t give you the core CNN content), or change of management - Jason Kilar took it live just before handing over control to the new Discovery owners. This is a footnote to the Netflix miss (except for the staff, given 90 days days notice, which is longer than the actual operations) but seems equally symbolic of the first phase of TV unbundling - just because you want a direct relationship with your users, that doesn’t mean they think about you at all 📰(Variety)

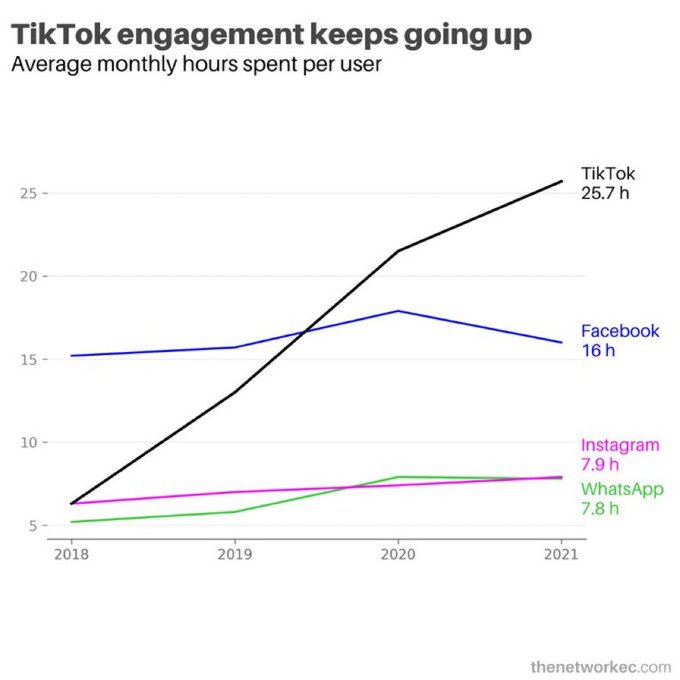

Lastly TikTok is continuing to take up significant passive screen time. @probably_paula who’s part of partnerships:

“Our users average 90 minutes on the app - essentially the duration of a film. Tiktok is an entertainment platform.”

📝 Unsolicited Advice

Kevin Kelly’s 📝list of unsolicited advice continues to grow. As he turns 70, it’s now hit 103 points. A couple highlighted below:

- About 99% of the time, the right time is right now.

- Dont ever work for someone you dont want to become.

- Anything you say before the word “but” does not count.

- When you lead, your real job is to create more leaders, not more followers.

- There is no such thing as being “on time.” You are either late or you are early. Your choice.

- The biggest lie we tell ourselves is “I dont need to write this down because I will remember it.”

- Copying others is a good way to start. Copying yourself is a disappointing way to end.

- We tend to overestimate what we can do in a day, and underestimate what we can achieve in a decade. Miraculous things can be accomplished if you give it ten years. A long game will compound small gains to overcome even big mistakes.

- Always read the plaque next to the monument.

- Ask anyone you admire: Their lucky breaks happened on a detour from their main goal. So embrace detours. Life is not a straight line for anyone.

🧾🎰 Lotto Tax

This trend is fairly consistent across countries.

The lowest 20% income group in the US spends more money on the lottery every year than any type of tax. pic.twitter.com/6EFAsmjHKx

— Daniel Kyne (@Daniel_Kyne) April 19, 2022

The sad part is how often eventual winners end up blowing most of the winnings, and often ending up in financial distress.

Per 📰WSP:

When a team of economists tracked the fortunes of financially distressed people in Florida who had won the lottery, they found that within three to five years, the winners of big prizes (between $50,000 and $150,000) were equally likely to have filed for bankruptcy as the small winners, and the groups had similarly low savings and levels of debt. According to the National Endowment for Financial Education, about 70 percent of people who win a lottery or receive a large windfall go bankrupt within a few years.

Case in point

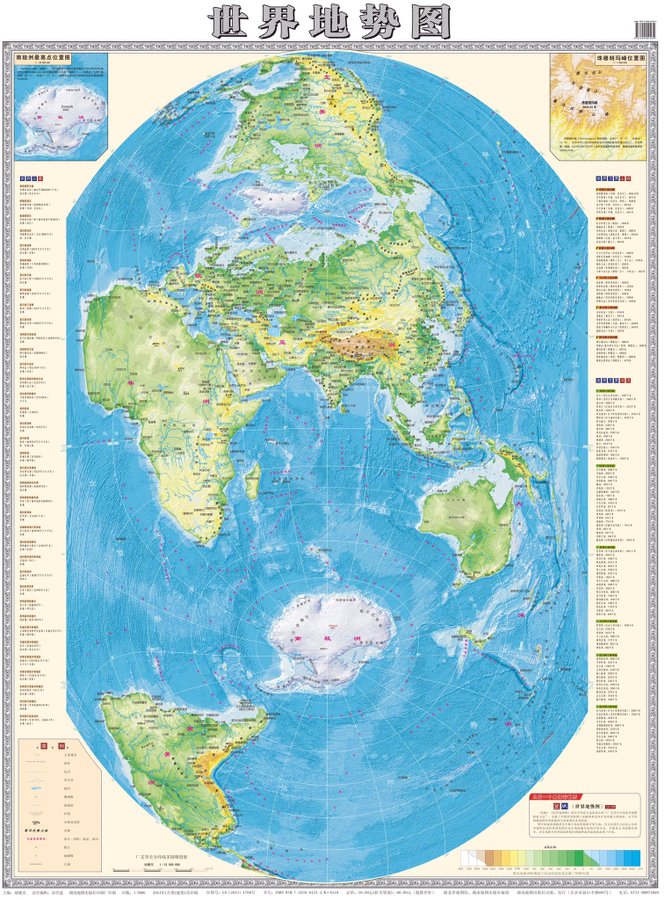

🗺️ Middle Kingdom

World Maps used by Chinese denizens. Always interesting to consider different perspectives.

For an even larger perspective shift, this is the Chinese “vertical” World Map, designed by He Xiaoguang 郝晓光 of Chinese Academy of Sciences 中科院.

👨💻📜 70s and 80s Programming

Best answer to this 📝Quora question: What were interviews for programming positions like in the 70s and 80s?

Back then, I was working in Fortran (and Z80, x86, PDP-11 assembler), maybe some C in the late 80s - mostly it was whether you had any background in what would now be called Software Engineering - that is, had you worked in an environment requiring coding to a coding standard, generating documentation, reading design docs. DoD-STD-2167A came in sort of in the middle of that period. You’d get asked what you had done before - how big a project, how many people did you work with, what was the development environment - back then there was a huge difference between “big iron” with card decks (and the virtual equivalent thereof) and “interactive” using text editors. If you were going into a “use TECO” environment and all your experience had been with OS/360, JCL, and job decks, it’s a significant change. There was also a difference between development for “interactive” applications and “batch” applications. Unix was really unusual back then - You were probably either working in batch (IBM, Burroughs, CDC) or working on a mini (DEC PDP-8,11/VAX/DEC10, PR1ME, Data General), each of which had their own tool chains, command line utilities, word length, character encoding (IBM: EBCDIC, DEC: ASCII, CDC:6bit), etc. If you were coding for a micro (8085, Z80, 6502), you might be working with a cross compiler on a bigger machine, or on some sort of hybrid scheme - Intel had development stations based on 8085s that ran compilers for the 8086, running some form of CP/M, as I recall. So, in an interview, they’d be trying to figure how long it would take you to get up to speed on whatever peculiar tool-chain they had at their place. If you had done development in half a dozen places with different tool chains, it was easy to get hired - they figured you had figured out 5 before, what’s a new one. Here’s your stack of manuals: go to it.

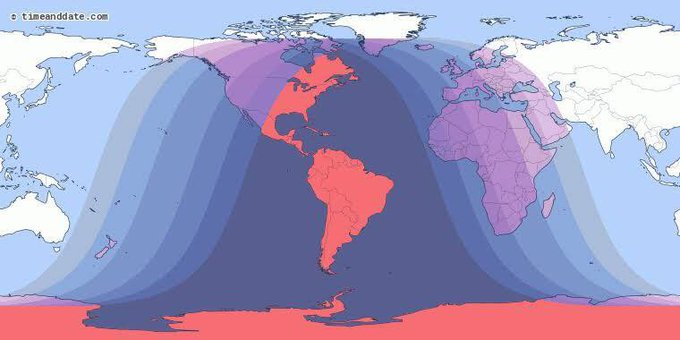

🌘 Eclipse

Where you can see the upcoming total lunar eclipse on May 16.

A total lunar eclipse happens when the Moon moves into Earth’s shadow - where the Sun, Earth, and Moon are perfectly lined up

⚔️ Realpolitik

The world’s largest arms suppliers and their clients over the past decade

Excellent discussion between Demetri Kofinas and Grant Williams where they grapple with what may turn out to be the greatest socio-economic and political changes in a century. As well as what these changes will mean for the future of democracy, civil society, and the viability of capitalism.

The second paywalled part of the conversation (Demetri’s pod definitely worth it) is all about how you choose to position yourself in anticipation of these changes is one of the most important challenges you will ever face as an investor and sovereign individual.

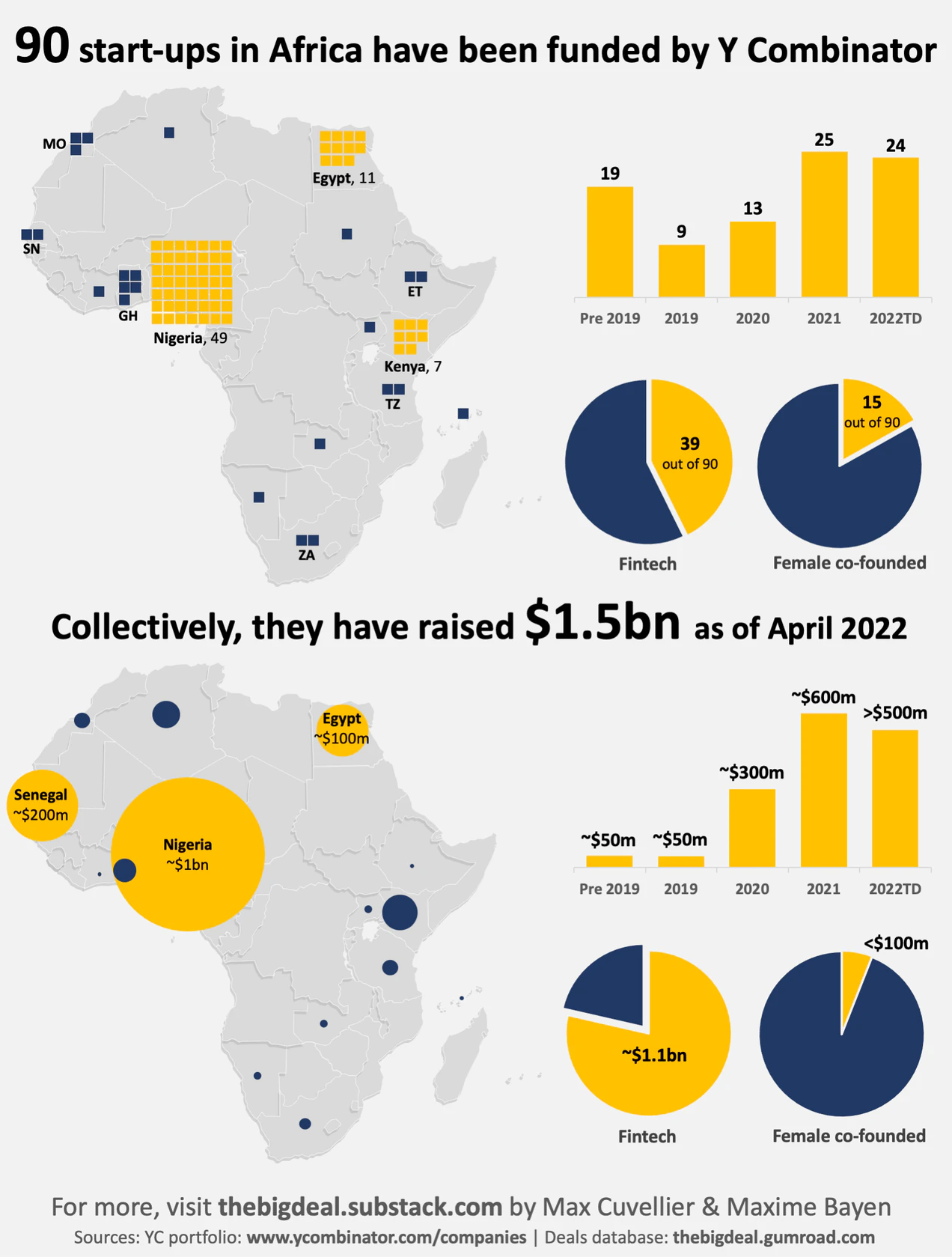

💰🌍 To YC or not to YC?

From Max Cuvellier’s 📝Africa: The Big Deal:

Who are the African YC start-ups? There are 90 of them (i.e. 2.5% of the total 3,655). More than half of them (49) are based in Nigeria, followed by Egypt (11), Kenya (7) and Ghana (5). Overall 16 countries are represented. The most represented sector is fintech (39, 43%), which is a much higher percentage than in YC’s overall portfolio (12%). Most of the African start-ups in YC’s portfolio are recent additions: 49 (54%) joined the portfolio in 2021 (25) and 2022 (24). 17% (15) have a female co-founder, which is slightly above YC’s global average (15%); most of these female co-founded start-ups are recent investments. Only a couple though have a female CEO.

How well have they done at fundraising? Collectively, they have raised nearly $1.5 billion. This number includes Paystack’s $200m acquisition by Stripe in 2020. Most of this funding ($1.1bn) has been raised since the beginning of 2021. More than two thirds of the total amount ($1bn) were raised by YC start-ups in Nigeria. Nearly 80% of the total amount raised went to fintech start-ups; Logistics & Transports (8%), AgriTech (6%) and HealthTech (4%) are the other sectors attracting investment, yet at much smaller levels. 19 of the start-ustps have already raised more than $10m, three of which have bagged $100m+ ‘mega deals’: Flutterwave (YC S16), Paystack (YC W16), and Wave (YC W12). Less than 6% of the funding was raised by female co-founded start-ups, and almost no none of the funding (<0.1%) has gone to female-led ventures.

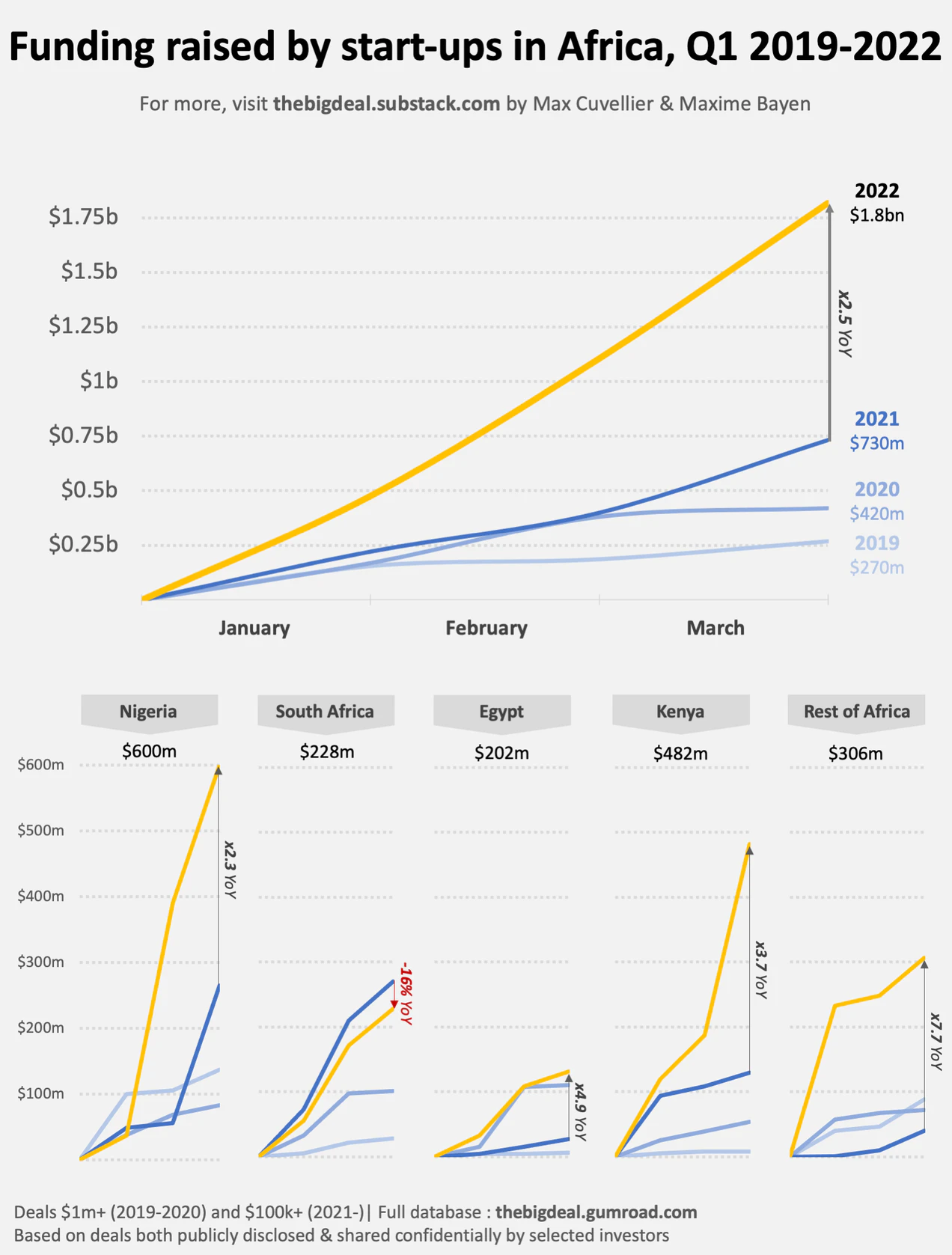

This is within the broader context of African startups having raised $1,8Bn in Q1 2022

📱🧠 Why Your Attention Sucks

From The Viewer:

Average time spent watching a YouTube video is a decent measure of its quality, but “when a measure becomes a target, it ceases to be a good measure.” With online creators desperately trying to capture attention, the average attention span is going down. One piece of evidence for this phenomenon is that the half-life of popular Twitter hashtags is decreasing over time

📝🛡️ Personal Security Checklist

TLDR version of Alicia Sykes’ excellent Personal Cyber Security Checklist on github. Full post highly recommended

Authentication:

- Use a long, strong and unique password for each of your accounts (see HowSecureIsMyPassword.net)

- Use a secure password manager, to encrypt, store and fill credentials, such as BitWarden or KeePass / KeePassXC

- Enable 2-Factor authentication where available, and use an authenticator app or hardware token

- When you enable multi-factor authentication, you will usually be given several codes that you can use if your 2FA method is lost, broken or unavailable. You should store these on paper or in a safe place on disk (e.g. in offline storage or as in an encrypted file/drive).

- Sign up for breach alerts (with Firefox Monitor or HaveIBeenPwned), and update passwords of compromised accounts

Browsing:

- Use a Privacy-Respecting Browser, Brave (My personal go-to) and Firefox are good options. Set your default search to a non-tracking engine, such as DuckDuckGo

- Do not enter any information on a non-HTTPS website (look for the lock icon), consider using HTTPS-Everywhere to make this easier

- Block invasive 3rd-party trackers and ads using an extension like Privacy Badger or uBlock

- Keep your browser up-to-date, explore the privacy settings and remove unnecessary add-ons/ extensions

- Consider using compartmentalization to separate different areas of your browsing (such as work, social, shopping etc), in order to reduce tracking. This can be done with Firefox Containers, or by using separate browsers or browser profiles

- Don’t allow your browser to save your passwords or auto-fill personal details (instead use a password manager, and disable your browsers own auto-fill)

- Clear your cookies, session data and cache regularly. An extension such as Cookie-Auto-Delete can be used to automate this

- Don’t sign into your browser, as it can link further data to your identity. If you need to, you can use an open source bookmark sync app

- Consider using Decentraleyes to decrease the number of trackable CDN requests your device makes

- Test your browser using a tool like Panopticlick to ensure there are no major issues. BrowserLeaks and Am I Unique are also useful for exploring what device info you are exposing to websites

- For anonymous browsing use The Tor Browser, and avoid logging into any of your personal accounts

Check out the subsections on Phones, Email, Secure Messaging, Networking, OPEN-SOURCE, PRIVACY-FOCUSED SOFTWARE and SECURITY HARDWARE as well.

🪐🔭 Mars & Conjunctions

This is ESP_073055_1675 from HiRISE camera onboard Mars Reconnaissance Orbiter. Frame height is approximately 1km taken from an orbit height of 250km.

HiRISE ( High Resolution Imaging Science Experiment ) is the most powerful camera ever sent to another planet, one of six instruments onboard the Mars Reconnaissance Orbiter. FAQ

Mars Reconnaissance Orbiter ( MRO ) is a spacecraft designed to study the geology and climate of Mars, provide reconnaissance of future landing sites, and relay data from surface missions back to Earth. Three cameras ( HiRISE, CTX & MARCI ), two spectrometers ( CRISM ) and a radar ( SHARAD ) are included on the orbiter along with two “science-facility instruments”, which use data from engineering subsystems to collect science data. MRO

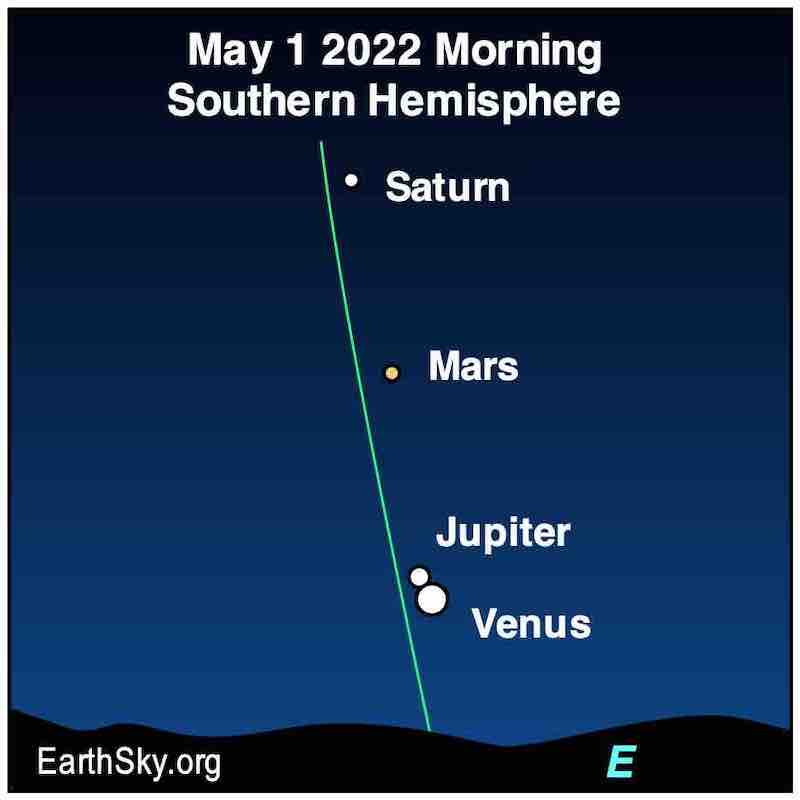

Indicentally for the skywatchers, we’ve been experiencing a conjuction of Saturn, Mars, Jupiter and Venus. They’ll all be very close together for the next week or so still.

🎨 Found Stones

Cherub, Justin Bateman, Found Stones, 2021

Scapigliata, Justin Bateman, Found Stones, 2021

David, Justin Bateman, Found Stones, 2021

💬 Deep Cuts

“The real problem of humanity is the following: We have Paleolithic emotions, medieval institutions and godlike technology.” - Edward O. Wilson

👽🛸👾 One More Thing

Cross-Dimensional Breach

📧 Get this weekly in your mailbox

Thanks for reading. Tune in next week. And please share with your network.

Links The Week That Was Pickings

fa17eab @ 2023-09-18