(This Week) Uber Eats, Oily Slides & Contact Tracing

12 April 2020

Welcome back to the Week That Was series where I highlight a few things from the interwebs which I thought were interesting, noteworthy and probably worth your time. Articles📝, Tweet(s)📱, Videos🎥, Charts 📈 all fair game with or without attendant commentary.

🚕🍲🍕 Food and Transport

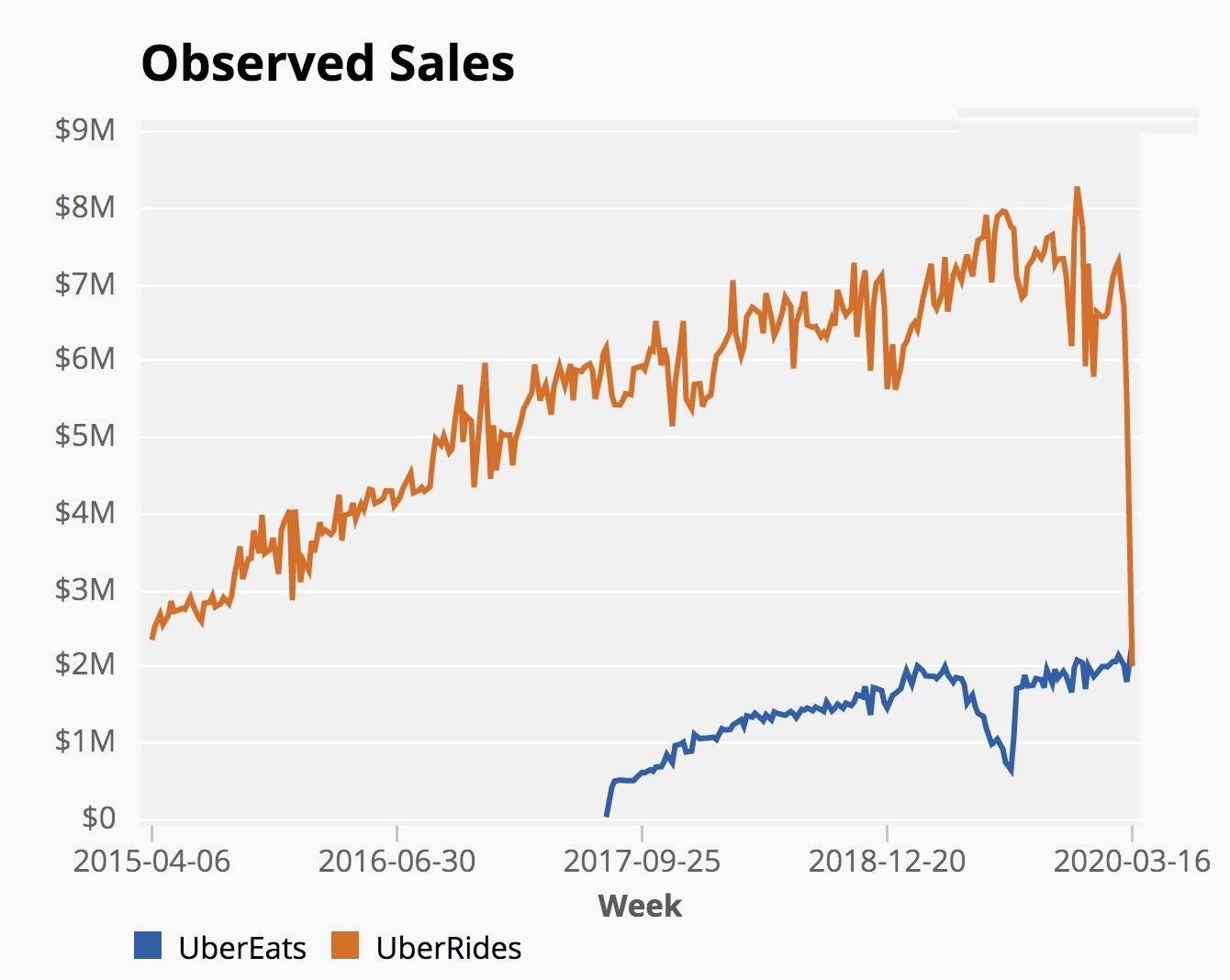

The current coronavirus-driven economic shocks are having all manner of effects, including Uber Eats now surpassing Uber in sales for the first time.

Credit: @tcitrin

📈📉 STONKS

The Boomer - Zoomer divide seems perfectly encapsulated by this image

Credit: @JustinAHorwitz

Credit: @StockCats

Billionaire early FB exec, Virgin Galactic chairman and current Social Capital founder Chamath Palihapitiya, seems to blow the CNBC anchor’s mind (the first 12 seconds 🤣) with what seem to be reminders about the alleged rules of capitalism.

The U.S. shouldn’t bail out billionaires and hedge funds during the coronavirus pandemic, Social Capital CEO Chamath Palihapitiya says. “Who cares? Let them get wiped out.” https://t.co/dIbizumtqG pic.twitter.com/u8BSVvr0B1

— CNBC (@CNBC) April 9, 2020

Chamath joins Anthony Pompliano aka Pomp on his podcast to unpack the subject in longer form.

₿💸 Choose Your Fiction

Arthur Hayes is a Citigroup and Deutsche Bank alumnus who has built one of the largest cryptocurrency derivatives exchanges globally called BitMEX, where he currently serves as CEO.

Here he delivers a full-throated, profanity-laced but detailed evaluation of current the current state of the global economy, monetary policy and why he is a markets bear and gold & bitcoin bull. Interesting albeit contrarian thoughts.

“The stock market of the Land of the Free will become a political tool. The US Treasury, powered by the Fed, will buy all government and corporate debt. They will buy equities. They will buy consumer loans.

🛢️⛽ Oily slide

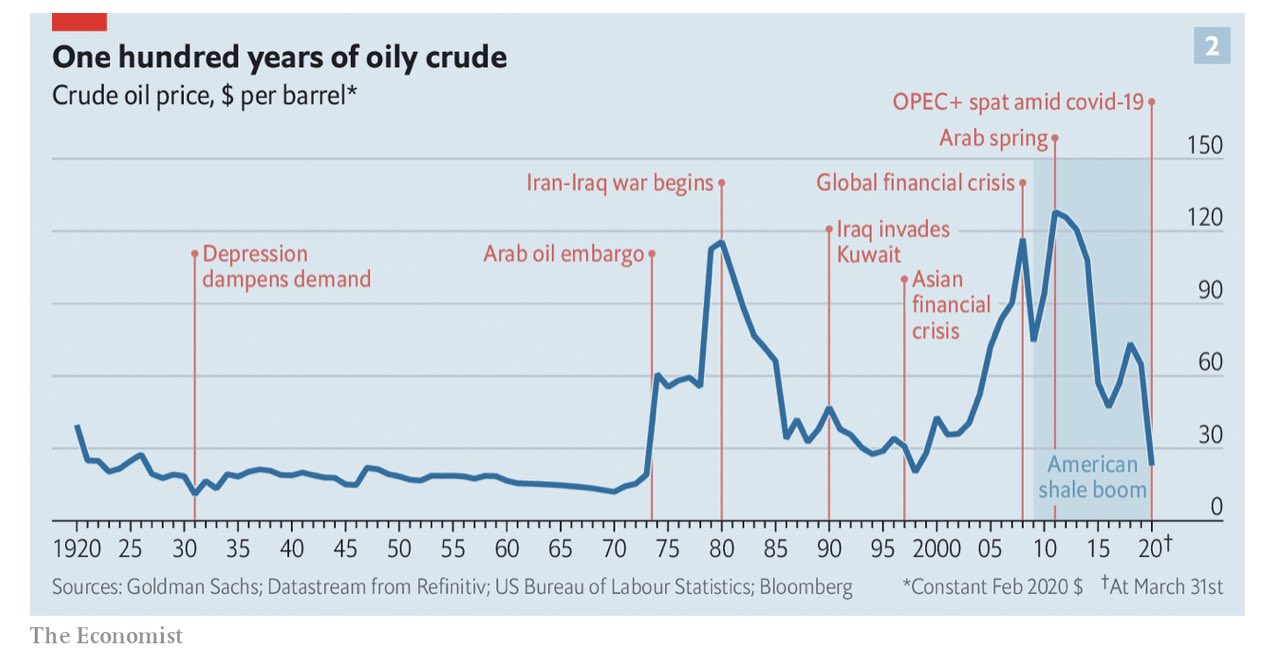

COVID-19 is joined by a price war between OPEC+ members and US oil, to wreak continued havoc on global markets.

WSJ’s Russell Gold discusses the global game of chicken inside the oil industry players that’s resulting in the picture above.

🦠🧼🖐💦⚕ Greenzone

🚫 Not Flu

Latest reminder that this isn’t “the flu”.

🔓 Wuhan Reopens

With Wuhan tentatively reopening to much fanfare, here’s a thread exploring what life looks like now and for the forseeable future there.

Been in Wuhan for a week now with @ClaireYChe and @sarahchen. Watching the city emerge from lockdown offers us glimpses of scenes that will likely unfold elsewhere as other cities try to get their economies back on track. Here are some stories that shed light on what’s to come.

— Sharon Chen (@sharonchenhm) April 11, 2020

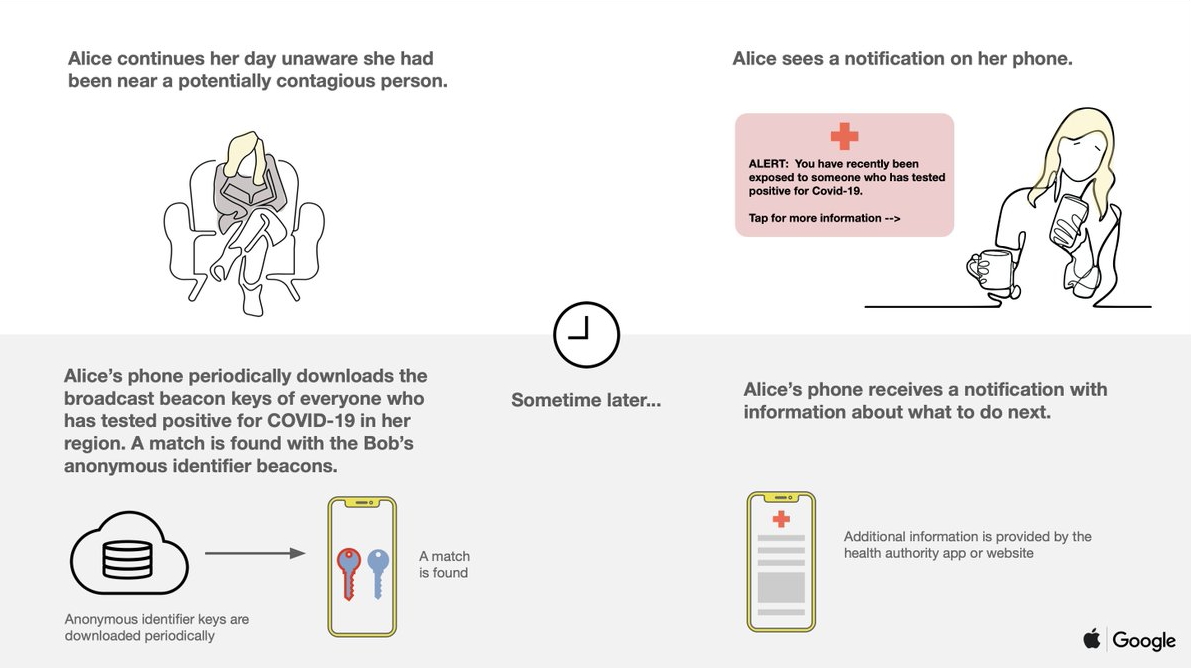

📱📝 Contact Tracing

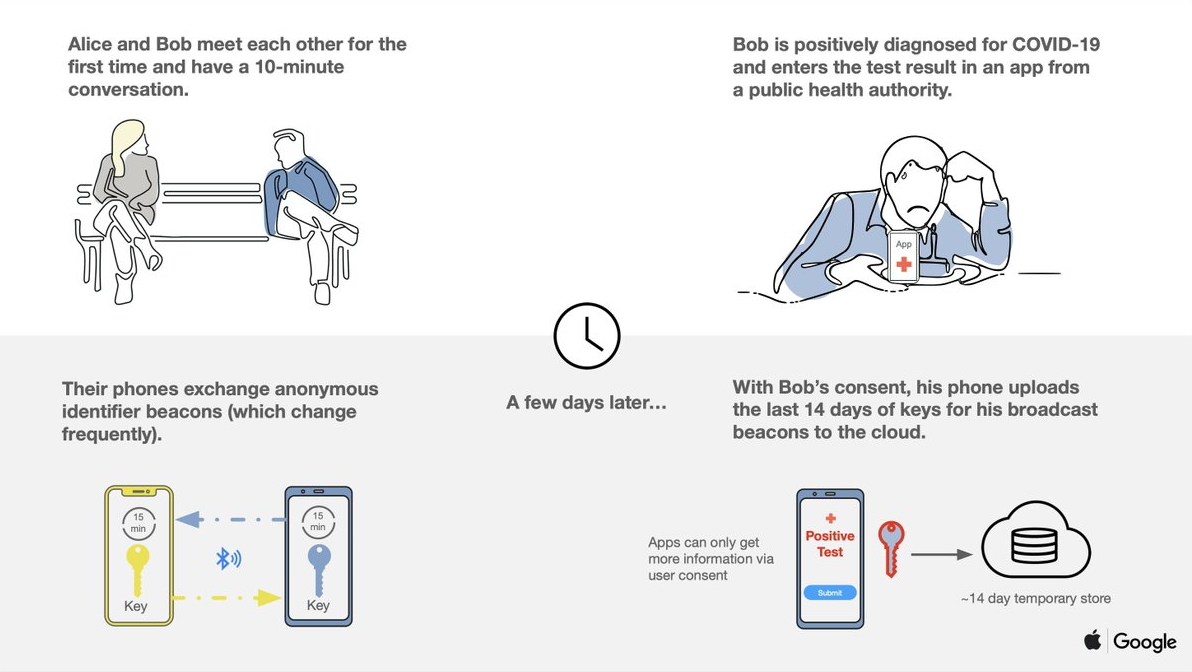

With various countries looking to bolster their contact tracing and monitoring efforts by leveraging location data from mobile network operators, we’re also seeing technology companies looking to offer solutions at scale.

Notably Google and Apple are partnering on a set of APIs to enable automatic, anonymised bluetooth-based contact tracing.

We’ll likely return to exploration of the liberty and privacy implications of current events in future iterations.

💬 Data

“Faith in data grows in relation to your distance from it

“A statistic always sounds more convincing the less you know about where it came from”

John Higgs: The Future Starts Here

🎥 Toni & Miles

I saw good profiles of the great Toni Morrison and Miles Davis over the last few days on Netflix. Definitely recommended viewing as a double-feature, diving into the lives and historical contexts of a legendary writer and a fantastic but complex musician.

Miles Davis: Birth of the Cool (2019)

Toni Morrison: The Pieces I Am (2019)

📺📉 Oh…and one more thing

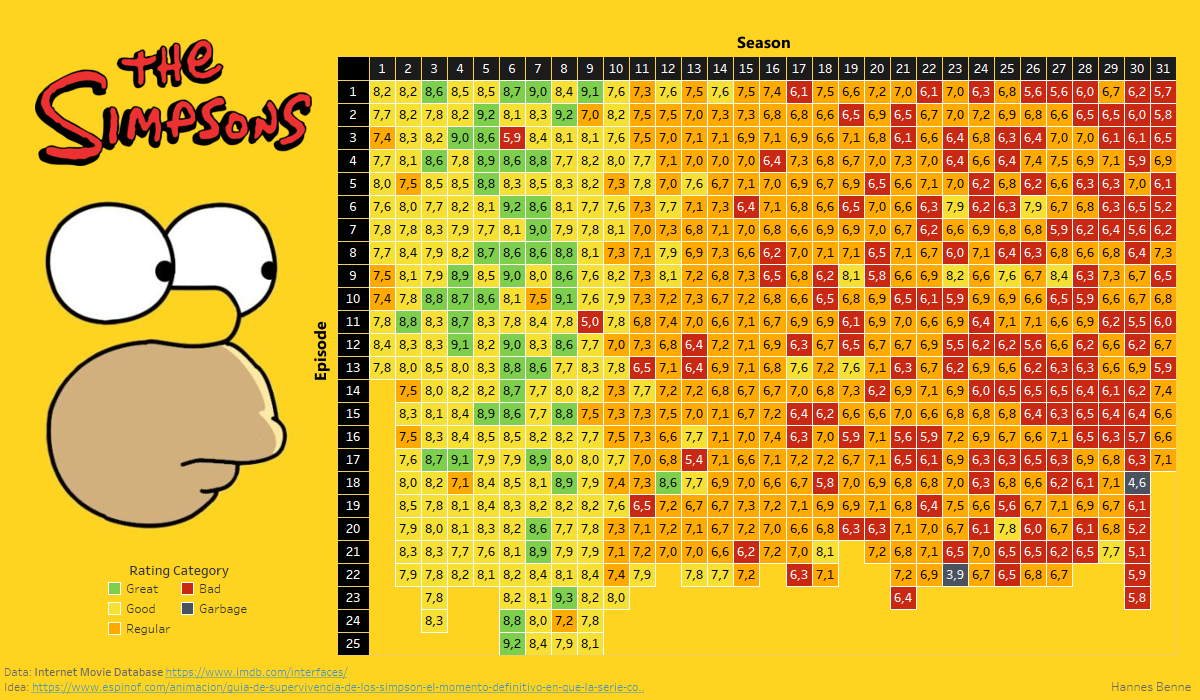

The IMDb ratings for all of the Simpsons seasons and episodes. Hard to miss the trend.

Thanks for reading. Tune in next week. Stay indoors. Keep in touch with your loved ones

Links The Week That Was Pickings

fa17eab @ 2023-09-18